Rocket fuel for Europe’s SpaceTech? Founder reacts to EIB’s new €500 million space programme

The European Investment Bank (EIB) has entered orbit with the launch of Space TechEU, a €500 million financing initiative targeting the European space industry.

Unveiled at the European Space Agency’s Council of Ministers in Bremen, the programme aims to stimulate around €1.4 billion in private investment by supporting SMEs and mid-cap companies operating across the space value chain.

“Through this new dedicated space finance programme, we will give banks across the EU the tools and the confidence to increase their financing for space companies in Europe across the entire space value chain”, EIB Vice President Robert de Groot said. “We are supporting the development of a strong, globally competitive European space industry – one that ensures more autonomy and contributes to our prosperity and security.”

The announcement marks a significant public commitment to a sector often hampered by long development cycles, opaque valuations, and limited access to traditional credit markets.

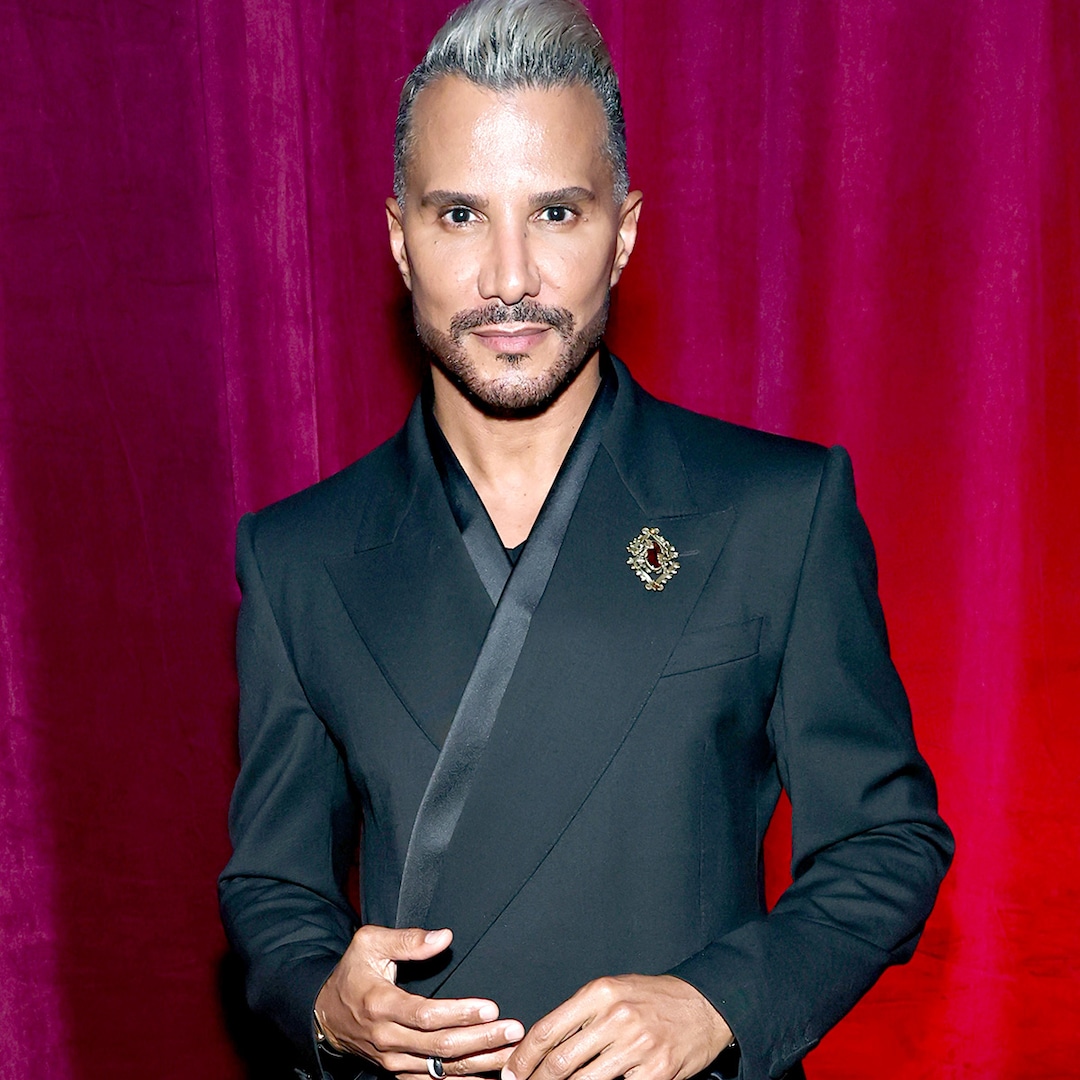

To understand the impact of this development in more detail, EU-Startups spoke to Francesco Cacciatore, Founder and CEO of Orbital Paradigm, a Madrid-based SpaceTech startup developing reusable space capsules for transport between Earth and orbit. The startup, founded in 2023, raised €1.5 million earlier this year to further develop its re-entry vehicle systems, placing it among the rising stars of Spain’s upstream space segment.

Our chat with Francesco Cacciatore, Founder and CEO of Orbital Paradigm

The new programme leverages ESA’s technical expertise alongside EIB financial instruments to help commercial banks better understand the unique risks and assets involved in space ventures.

It is a move designed to ease a long-standing constraint in the sector: financial institutions often shy away from space projects due to the high technological complexity and lack of internal sector knowledge.

But for early-stage startups like Orbital Paradigm, the direct benefits of Space TechEU may be limited in the short term.

Still, Cacciatore notes that the implications for investor confidence are potentially game-changing. “I think it is a good sign that capital is being seen in advanced stages, as it gives those who invest in early stages the security of knowing that companies will not later find themselves without financing options. In general, even in the space sector, the EIB itself has very conservative risk patterns when compared to an early-stage startup,” he added.

That signalling effect could be key for founders navigating the capital-intensive realities of upstream hardware development.

Orbital Paradigm, like many of its peers, is not yet in a position to access venture debt due to limited revenue. But that does not mean bank financing has no role.

“We are dedicated to reusable space transport, and we have been in business for two years. We are far from being in a revenue position that could justify healthy venture debt, even coming from the EIB. I believe that this capital should be used for more advanced phases, and that the existence of such support will be beneficial because it will allow early investors to see possibilities for accessing more substantial capital to scale up,” Cacciatore noted.

In terms of practical application, he sees potential use cases for bank financing where collateral can be offered – particularly in the procurement of heavy manufacturing equipment. “If I had to think about bank financing for a company like ours in the early stages right now, it might be interesting for CAPEX related to heavy equipment, which could be put up directly as collateral, for example.

“If the EIB encourages banks to take on this type of risk, it could allow young companies access to expensive infrastructure. If things went wrong, the bank would still have the equipment itself as collateral: it would not be ideal, but that is the nature of the risk.”

Yet, even with such possibilities, the structural constraints of the sector remain. Cacciatore underlined several pain points common across the industry, from long development cycles to the niche nature of asset valuation.

“This is a very complex question, and I think it has to do with the market as a whole. To get to the point: in the space world, for the upstream segment with hardware, there are some unique complexities. To give an example, to build equipment that goes into space, in addition to the costs of building it, there are qualification and launch costs to contend with.”

And even when government contracts are on the table, the timing is not always in a founder’s favour.

“In the institutional market, contracts are subject to the pace of the institutions and the political decisions that govern the ESA’s three-year budgets,” he said. This cyclical uncertainty further complicates how a startup can structure its growth or predict cash flow.

The valuation challenge is another underappreciated hurdle. “When it comes to establishing the value of a space company, I suppose that valuing certain assets can be complicated, and the number of people capable of doing so must be very limited, which further complicates access to credit,” he explained.

This is where ESA’s involvement in Space TechEU could be critical.

By offering technical due diligence and helping banks interpret the strategic value of space technologies, ESA can act as a bridge between entrepreneurs and financial institutions.

“I believe that the fundamental aspects are support in identifying and defining technical risk, market-related information, and being able to provide a certain seal of confidence. In general, access to bank financing is related to risk profile, and the space industry remains a niche that is difficult to understand. Lack of knowledge increases the perception of risk,” Cacciatore said.

How does the SpaceTech sector look like and how is funding flowing?

The timing of Space TechEU’s debut also coincides with a strong year for European SpaceTech.

In 2025 alone, notable upstream fundraises have included Reflex Aerospace (€50 million), Infinite Orbits (€40 million), UNIVITY (€31 million), U-Space (€24 million), Kreios Space (€8 million), and Spaceflux (€6.1 million).

This reflects approximately €159 million in disclosed private investment across Europe’s space sector in 2025, excluding the EIB’s newly promised involvement.

Add to this Orbital Paradigm’s own €1.5 million raise, and the picture that emerges is one of a maturing ecosystem gradually moving beyond the pure R&D phase into commercially scalable models.

Still, the capital gap between early equity funding and bankable growth finance remains vast – and that is precisely the terrain Space TechEU hopes to smooth.

While early-stage startups are unlikely to apply directly for EIB-backed instruments today, their future investors may take comfort in knowing that institutional support exists on the other side of the growth curve.

The post Rocket fuel for Europe’s SpaceTech? Founder reacts to EIB’s new €500 million space programme appeared first on EU-Startups.